Your First Buyer-Seller Meeting: What to Expect and How to Prepare

Serena

January 23, 2025 ⋅ 4 min read

The first meeting between a buyer and seller is a pivotal moment in the journey of selling your small business. This is your opportunity to showcase your business, establish trust, and determine if the buyer could be the right fit for taking over your legacy. But how do you make the most of this crucial conversation? Let’s dive into what you can expect and how to set yourself up for success.

What Is a Buyer-Seller Meeting?

Think of this initial meeting as the “get-to-know-you” phase of the transaction. It’s your chance to provide a behind-the-scenes look at your business while learning about the buyer’s plans, vision, and expectations. Here are some topics buyers typically inquire about:

Operations: What are the day-to-day processes that keep your business running smoothly?

Potential Growth: Where are the key opportunities for a buyer to scale or innovate?

Staff and Turnover: What’s your team structure like, and what kind of employee retention have you experienced?

Transition Expectations: What role (if any) do you want to play during the transition of ownership?

Financials: Can you provide more context on why the revenue in X year was lower than average? Could you clarify the details behind this one-time expense line item?

The goal isn’t to dive into every detail but to start a dialogue that establishes mutual interest and aligns your visions for the future.

What Shouldn’t Be on the Agenda?

It can be tempting to dive into pricing during this first meeting—after all, numbers matter! However, discussing price at this stage is rarely productive. Why?

Negotiations are typically most effective after an LOI (Letter of Intent) has been submitted by the buyer.

Your M&A advisor is best positioned to guide these conversations strategically, ensuring we maximize the value of your business.

If the topic arises, feel free to acknowledge it while deferring specifics. A simple, professional response like, “I’d like to defer valuation discussions to my advisor, but I am happy to cover any inquiries on the financials,” keeps things on track while setting expectations.

What If You Don’t Have All the Answers?

No one expects you to have every single detail on hand. If a buyer asks a question you’re unsure about, it’s perfectly fine to say,

“That’s a great question. I’ll confirm the details and get back to you.”

This approach not only buys you time but also demonstrates that you’re thoughtful and thorough—two qualities that inspire buyer confidence.

Setting the Stage for the Next Steps

By the end of your buyer-seller meeting, it’s helpful to establish what happens next. Typically, the process looks like this:

Due Diligence: The buyer is likely to have additional questions about operations and financials and may request supporting documentation.

Follow-Up Meeting (Virtual or In-Person): The buyer may request another video call to conduct a deep dive on their outstanding questions and concerns. If there’s mutual interest, the next step could involve an in-person walkthrough or coffee chat.

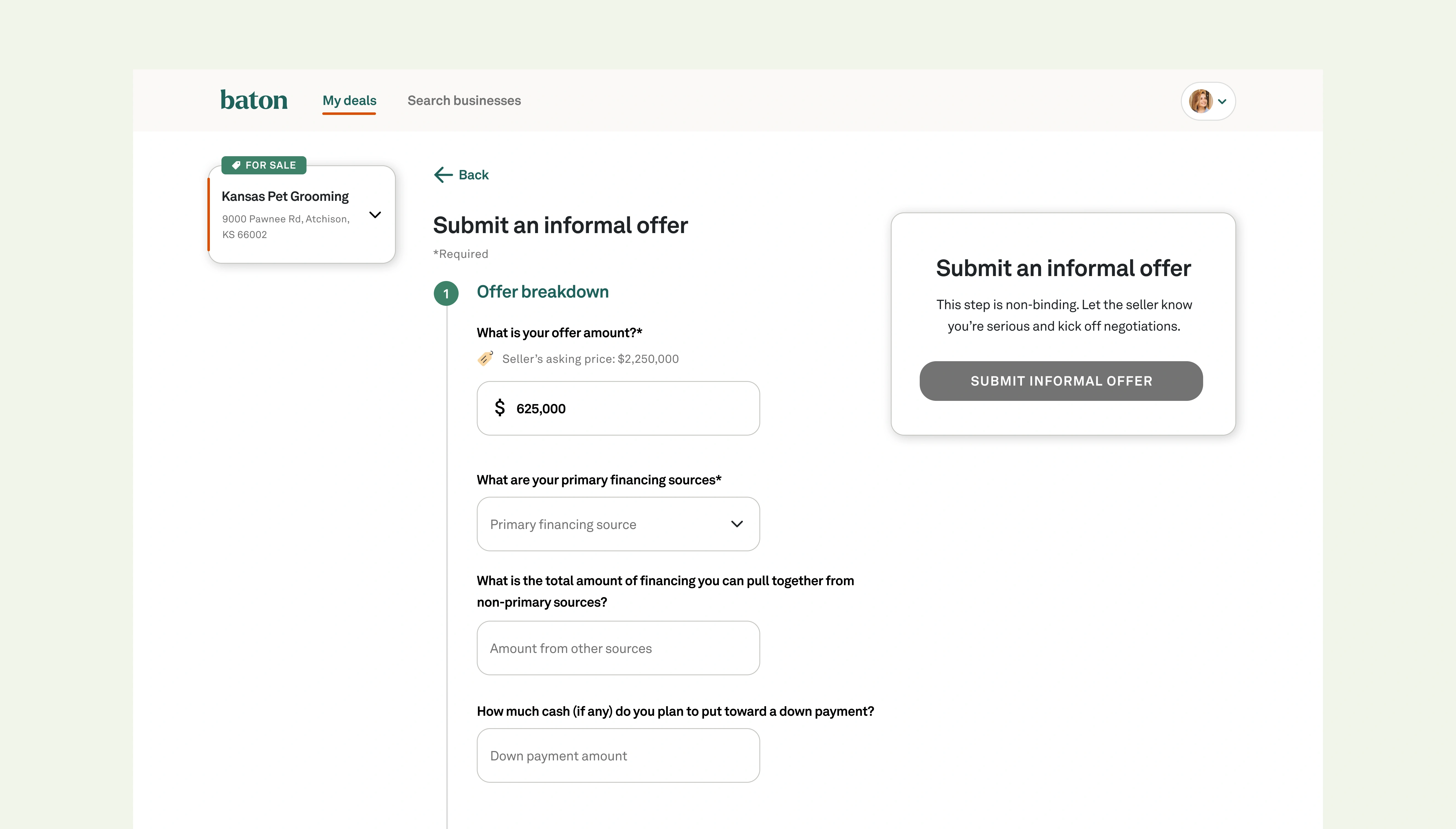

LOI (Letter of Intent): Once a buyer has completed their due diligence, the next stage is for a buyer to submit an offer on the Baton dashboard.

Clear communication about these next steps ensures everyone leaves the meeting with clarity and momentum.

A Few Final Tips

Be Transparent: Honesty builds trust. If there are challenges in your business, frame them as opportunities for improvement.

Be Prepared: Have key information (like financials and operational details) at your fingertips.

Be Open-Minded: Not every buyer will be the right fit—and that’s okay!

Remember, your first buyer-seller meeting isn’t about closing the deal—it’s about building a connection and laying the groundwork for what could be a successful transition. By focusing on open dialogue, establishing trust, and clear next steps, you’ll set the stage for a smooth negotiation process and a successful sale.

This is your chance to inspire the buyer with your vision and show them the incredible potential your business holds for the future, and by the end, you’ll be one step closer to finding the perfect buyer for your business!